The Cannabis Wire Daily newsletter is sent to C-Wire Plus subscribers every weekday morning at 7 a.m. Excerpts are published here later in the day. Don’t miss the full picture. Subscribe now.

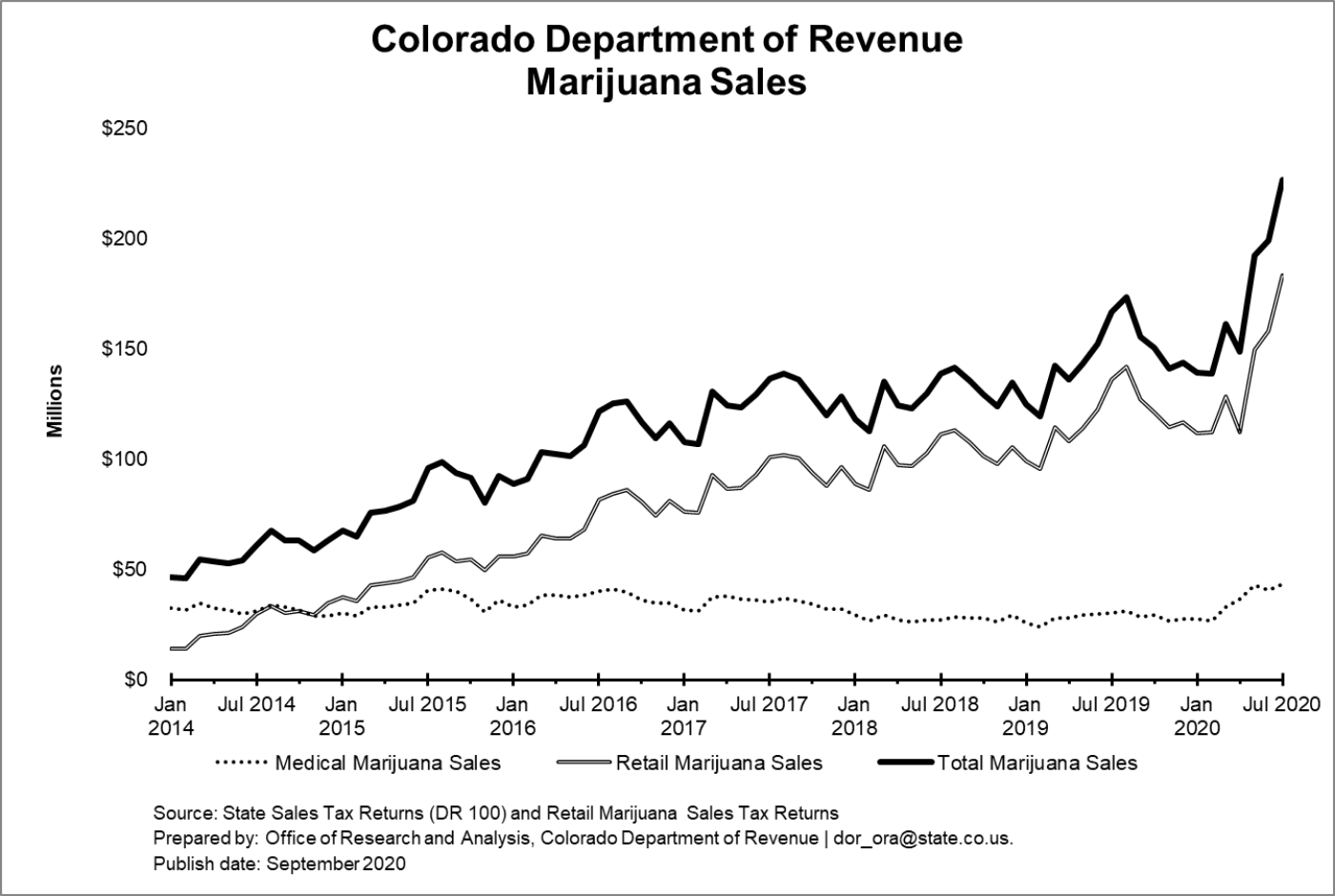

Colorado cannabis sales continue to spike.

In June, we noticed quite a spike in Colorado’s monthly cannabis sales, but July was unprecedented: cannabis sales in the state for the month exceeded $200 million.

Colorado’s mid-year report shows adult use market outpaces medical, and most businesses pass age-verification checks.

The Department of Revenue’s Marijuana Enforcement Division (MED) released its 2020 mid-year update, which covers the time period between January 1 to June 30, when the industry was “greatly affected by COVID-19.” This data came from the state’s seed-to-sale tracking system.

The adult use program continues to outpace the medical program. For example:

• 76% of the 80 new business licenses were for the adult use program

• adult use sales made up 63% of the pounds of flower

• 88% of the units of edibles sold

• 86% of the units of non-edible infused products sold

• 65% of the pounds of concentrate sold

• 84% of the units of concentrates sold

Also, most businesses are passing age-verification checks: a total of 97% businesses passed.

Another governor calls for cannabis amid COVID-19.

New Mexico Gov. Michelle Lujan Grisham called out cannabis legalization, briefly, during a recent broadcast COVID-19 update briefing. After noting that the state will need to seek “innovative ways to increase economic activity,” she said, “I’ll make a plug: recreational cannabis is one of those areas where that’s $100 million. And it doesn’t fix it, but it plugs one of those holes, potentially would be enough to do a whole lot in the Medicaid gaps.”

The governor has long pushed for cannabis legalization, but the effort ultimately hit a wall in early 2020. You can read Cannabis Wire’s coverage of those efforts here.

How much tax revenue could Connecticut see from legal cannabis?

Fred Carstensen, the director of the Connecticut Center for Economic Analysis, wrote a report titled “Projecting Economic Impacts of Legalizing Marijuana in Connecticut.”

The Center estimates, “depending on which tax regime Connecticut adopts and how the state chooses to spend those new revenues,” the following in state tax revenue:

• Year 1: $35-$48 million

• Year 5: $188-$223 million

The report notes: “Including indirect and induced impacts, CCEA predicts total state tax revenues reaching $235-$314 million in the fifth year. Aggregate new state tax revenues over five years range from $784 to $952 million.”

As for jobs:

• Year 1: 5,669-7,418

• Year 5: 10,424-17,462