The Cannabis Wire Daily newsletter is sent to C-Wire Plus subscribers every weekday morning at 7 a.m. Excerpts are published here later in the day. Don’t miss the full picture. Subscribe now.

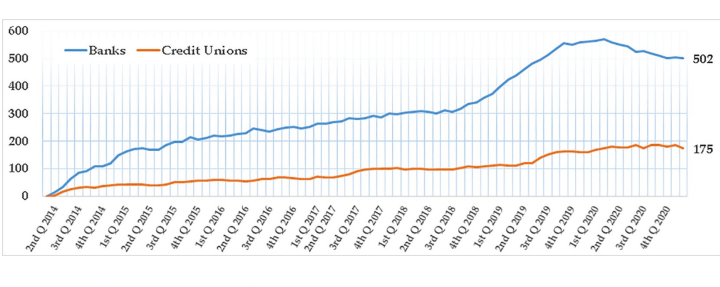

The number of banks working with cannabis businesses continues to drop.

“Short-term declines in the number of depository institutions actively providing banking services to marijuana-related businesses (MRBs) may be explained by filers exceeding the 90 day follow-on Suspicious Activity Report (SAR) filing requirement,” according to the Financial Crimes Enforcement Network (FinCEN) Marijuana Banking Update, which includes SARs filed through September 30.

Some filers require half a year (or more) to file their continuing activity reports, but after 90 days, this bank isn’t counted as “providing banking services until a new guidance-related SAR is received.”

In addition, FinCEN notes that the continued decline, while slight, could be due to two other reasons, both COVID-19-related: some cannabis businesses have been shuttered or operating at a lower capacity during the pandemic, and some depository institutions could be operating with fewer staffers, resulting in delays filing SARs.

California cannabis tax revenue continues to climb.

The California Department of Tax and Fee Administration released Q3 2020 cannabis tax revenue:

Excise tax: $159.8 million (up from $135 million in Q2)

Cultivation tax: $41 million (up from $30.7 million in Q2)

Sales tax: $105.9 million (up from $94.5 million in Q2)

Total: $306.7 million (up from $260.2 million)

Since adult use sales launched in January 2018, the state has earned $1.81 billion in cannabis tax revenue.

Cannabis opposition strategy? Lawsuits aiming to invalidate voter initiatives.

Lawsuits are now underway in Mississippi, Montana, and South Dakota, to block medical or adult use cannabis. Voters in these states passed cannabis initiatives on Election Day, but lawsuits have been filed by opponents to invalidate the results.

In Mississippi, the state Supreme Court will hear arguments related to a lawsuit brought forth by the city of Madison, which aims to invalidate the results because they say the legislature didn’t update guidelines for petitioners.

In Montana, Wrong for Montana, a group that opposes legalization, filed a lawsuit because they say that the language of the initiative itself is “unconstitutional” because it references how tax revenue will be allocated, and the group notes that only the legislature can do that.

In South Dakota, voters passed both medical and adult use legalization on the same day. Now, two members of law enforcement have brought forth a lawsuit against the adult use initiative language that they say breaches the state’s single subject rule. (This argument, as Cannabis Wire reported, was successful in Nebraska.)